CRM

The T100 CRM centralises every interaction and piece of client information, from onboarding to trading history and ongoing reviews into one secure record.

Designed for regulated markets, it integrates seamlessly with T100 Core and the Compliance Diary to ensure that you always have a single source of truth.

The purpose built CRM for regulated financial services

Regulated firms need more than a generic CRM. T100 CRM centralises every client interaction and document in a single record. It integrates seamlessly with T100 Core and the Compliance Diary, giving sales and compliance teams a single source of truth while automating many of the checks required by KYC/AML regulations

Designed specifically for regulated financial services

End‑to‑end client tracking from first enquiry through long‑term retention

Compliance embedded directly in the sales process

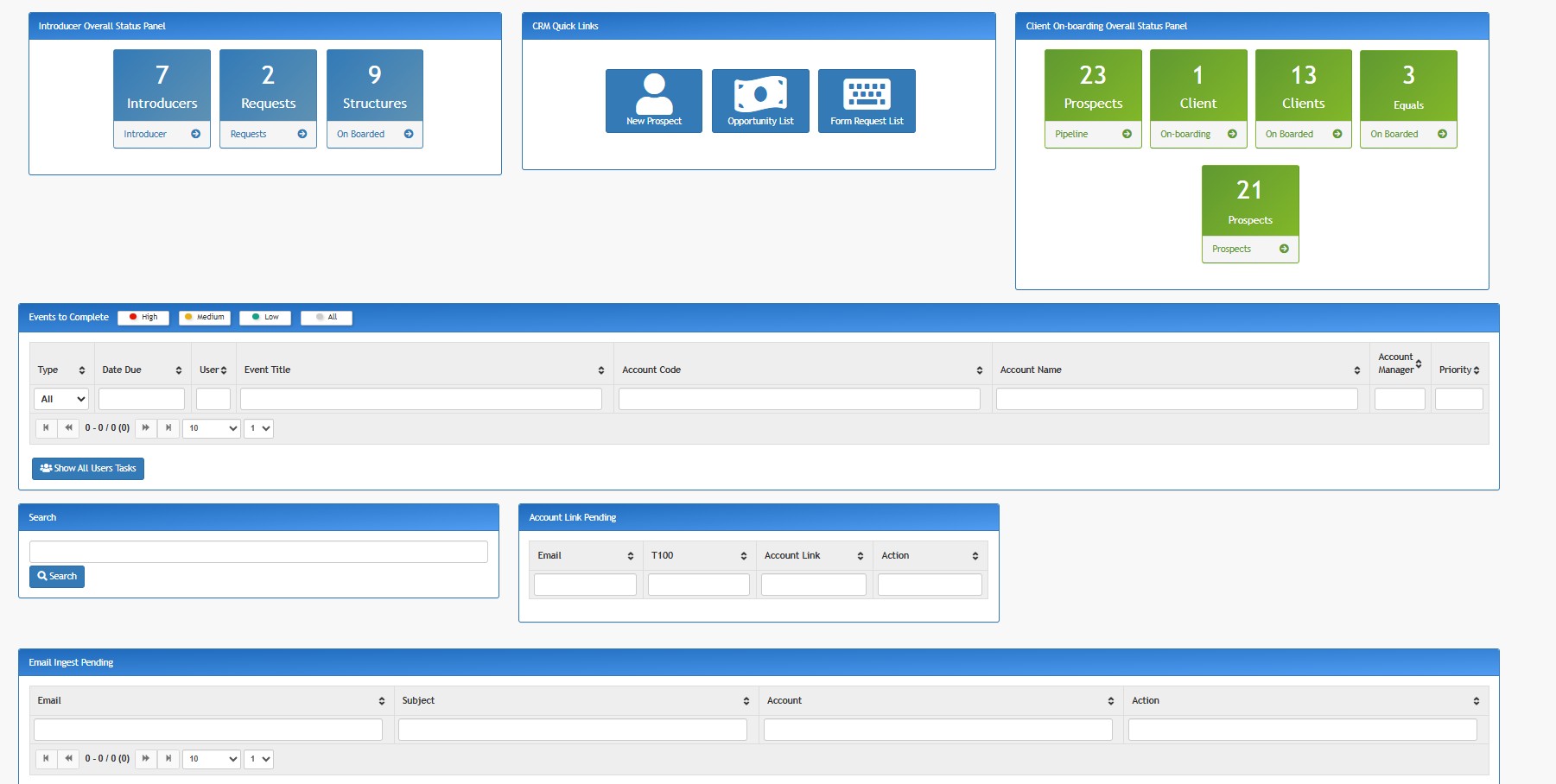

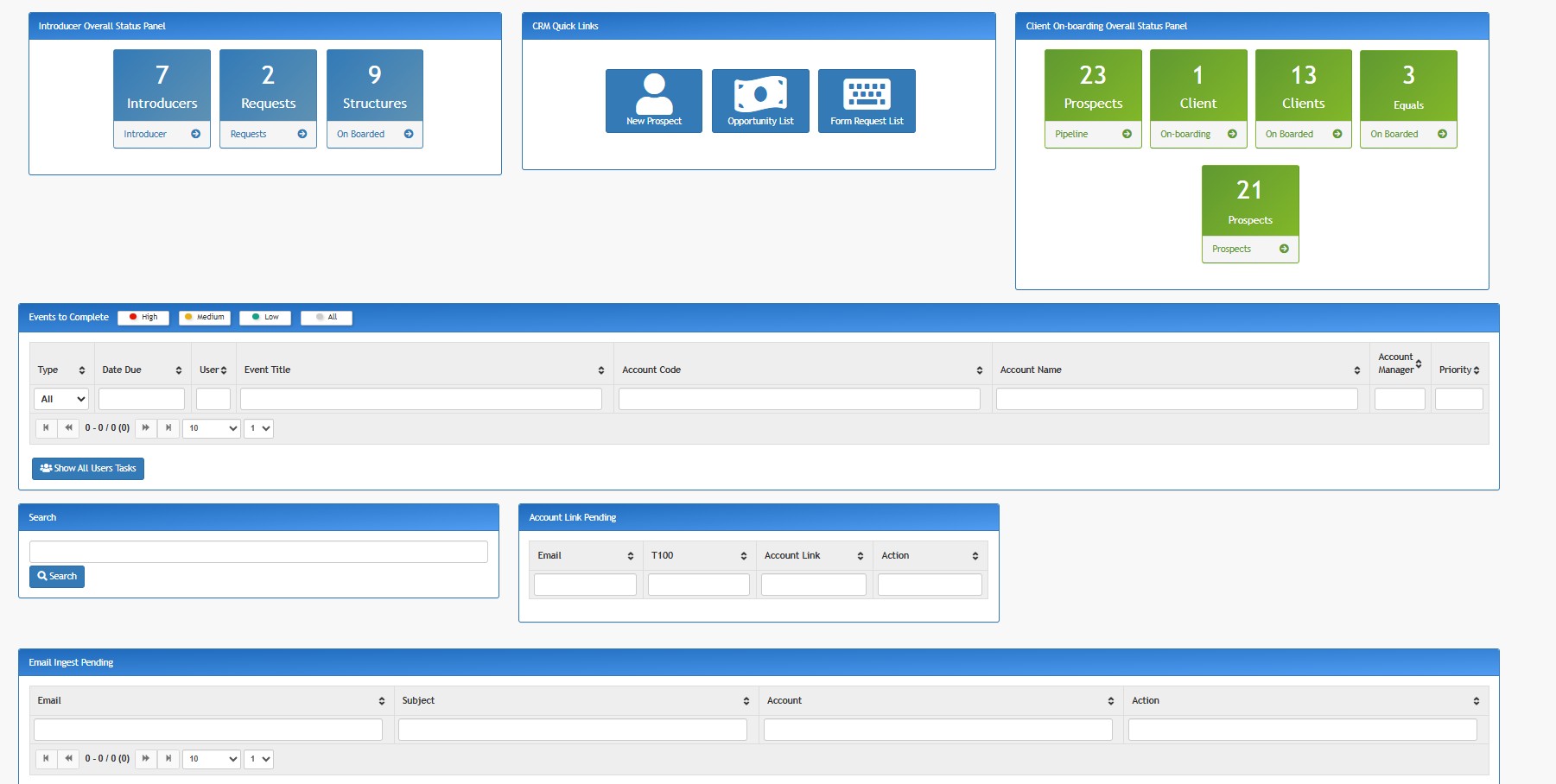

Simplify relationship management

T100 CRM streamlines daily operations so your team can focus on clients.

Centralised client records

Capture contact details, onboarding documents, KYC and AML status, risk scores and trading activity in one place.

Workflow automation

Tasks and reminders prompt your team to complete due‑diligence reviews, document renewals and periodic assessments on schedule.

Audit ready communication logs

Emails, calls and meetings are logged automatically with date and time stamps, creating a complete evidence trail.

Commercial oversight and growth clarity

Management needs clear insight into sales performance without adding administrative overhead.

T100 CRM provides visibility across sales activity and client acquisition, helping teams understand pipeline progression, conversion trends and where new business originates

You can drill down by source — websites, events or introducer networks — to focus effort on the channels that perform best

This clarity supports better forecasting and more focused commercial decision‑making